As businesses and schools move their staff to remote work environments, it’s easier than ever to lose track of company equipment. Companies lose thousands or even millions of dollars each year with improper asset tracking. Many companies do not even know where to start or the fixed assets they own, opening them up to losses and liability.

This blog post will explain the types of assets you absolutely should be tracking and hopefully get you thinking about ways to implement a well planned asset tracking system for your company.

Fixed assets have a specific meaning when it comes to accounting. They are physical entities such as buildings, equipment, furniture, and other property. To be considered a fixed asset, the purchased items must be expected to be used for longer than a year. Additionally, the items must be directly involved in the operation of your company.

What Are Examples of Fixed Assets?

Buildings: All of your facilities

Computer Equipment: Your computers, servers, laptops, tablets

IT Software: Any software that you purchase outright, not leased or paid as a service

Furniture: Your tables, chairs, filing cabinets, etc.

Property: The cost to purchase land and any land improvements

Machinery: Machines used for production

Equipment: Can include office equipment or field equipment

Vehicles: Your company cars, trucks, bicycles, and other motor vehicles

Some of these items, like buildings and property, will never move, but it is important to keep track of their purchase costs and depreciation for audit and tax liability purposes.

Other items are distributed to employees and may not be in a fixed location, like laptops and vehicles. When you track these items, it allows you to ensure accountability for the items as well as for purchase and tax purposes.

Start by writing down the assets your company or school has and pull in other department heads to help complete a thorough list.

What Aspects of Fixed Assets Should I be Tracking?

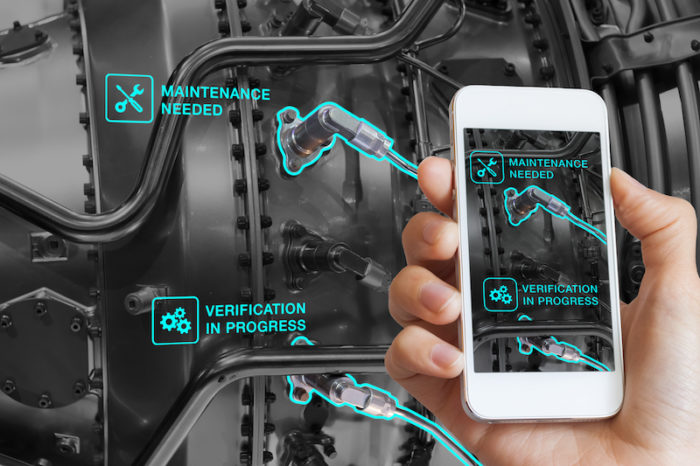

Once you have your list of the types of fixed assets to track. The most important thing to remember is that your data needs to be kept up-to-date on not only where an item is and who has custody over that item, but if / when items need to be maintained via a maintenance schedule.

The world is changing fast, asset tracking has never been more vital.

Here is a good starting point of what to track on each fixed asset:

- Vendor (This is the company you purchase assets from)

- Purchase Cost (this is needed if you’re tracking asset depreciation)

- Serial Number (important for warranty information)

- Warranty Expiration Date

- Location of the asset

- Who has custody over the asset

Asset Maintenance

If your company has equipment that needs maintenance every so often, such as a safety inspection or calibration. You’ll want to document this too. Reftab has a dedicated maintenance module designed specifically for asset maintenance.

Asset Depreciation

If your company needs to track the depreciation of assets for accounting purposes, Reftab has a dedicated depreciation module designed specifically to track asset depreciation.

What Are Not Examples Fixed Assets?

Anything that your company purchases with the intent to sell is not a fixed asset. This includes stock and inventory.

For example, if you’re in the retail clothing business, the clothes that you sell online or in store are not fixed assets. That clothing is your inventory and should be tracked in a designated inventory platform such as QuickBooks.

What are Consumables?

Consumables are a form of assets, however, they are items that are used and not returned into operating stock. The reason to track a consumable is to keep informed of a running total of available quantity.

For example, screws, printer ink, t-shirts that you give to employees, construction vests and so forth. These are items that get used up and once they are used, are either thrown away or not able to be used again. A system that keeps you informed of how many you have at any given time is ideal so you don’t needlessly purchase equipment. Reftab has a dedicated consumable tracking feature.

Conclusion

Asset tracking is something every business needs to do. It’s important to have a reliable way of knowing how much equipment you have, where it is and be able to easily manage maintenance and depreciation.

Your organization should be tracking the assets that help your business operate and grow. Fixed assets are equipment that helps your business make money, they should be well maintained and accounted for.

In short, keeping an up-to-date asset register will save you and your company time and expense. You should be focusing on running your business instead of the hassle of working with broken equipment or needlessly ordering duplicate equipment which wastes money and resources.

Is your company doing asset tracking?

Reftab is free for your first 50 assets. Start tracking assets today!